Are you looking to maximize your cryptocurrency mining profits? Mining Bitcoin, Ethereum, or other digital assets can be lucrative, but it requires strategic optimization. This article will explore five key strategies to significantly boost your mining returns, covering everything from choosing the best mining hardware and efficient power management to leveraging cloud mining services and joining a mining pool. Discover how to enhance your cryptocurrency mining profitability and navigate the competitive landscape of digital asset mining.

Choosing the Right Mining Hardware

Selecting the appropriate mining hardware is crucial for maximizing profitability. The most profitable hardware will depend on the cryptocurrency you intend to mine and its associated algorithm.

For Bitcoin and similar cryptocurrencies using the SHA-256 algorithm, ASIC miners are significantly more efficient than GPUs. These specialized machines are designed for optimal hash rate and power consumption for this specific algorithm.

Alternatively, for cryptocurrencies utilizing algorithms like Ethash (formerly used by Ethereum), GPUs remain a competitive option. However, the efficiency of GPU mining can vary significantly depending on the specific GPU model and its hash rate.

Before purchasing, carefully research the hash rate, power consumption, and noise levels of potential hardware. Consider the total cost of ownership, including electricity costs and potential maintenance expenses.

Furthermore, stay updated on the latest hardware releases. The mining landscape is constantly evolving, and newer hardware often offers improved efficiency and profitability. Monitoring industry news and reviews is crucial to making informed decisions.

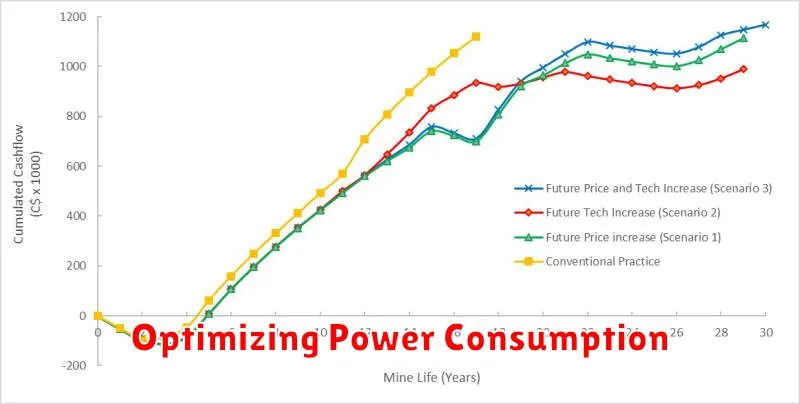

Optimizing Power Consumption

Power consumption is a major expense in cryptocurrency mining. Optimizing this area is crucial for profitability. Consider these key strategies:

Efficient Hardware: Invest in energy-efficient ASIC miners or GPUs designed for mining. Newer models often offer significant improvements in hash rate per watt.

Cooling Solutions: Proper cooling is paramount. Overheating significantly reduces efficiency and lifespan. Implement effective cooling systems, such as dedicated fans or liquid cooling, to maintain optimal operating temperatures.

Power Management: Utilize power management software to monitor and control energy usage. This allows for dynamic adjustments based on network difficulty and electricity prices.

Location, Location, Location: Consider mining in areas with low electricity costs. This can dramatically reduce operational expenses and boost profitability.

Overclocking (with caution): Carefully consider overclocking your mining hardware. While it can potentially increase hashrate, it also increases power consumption and may shorten the lifespan of your equipment. The gains must outweigh the risks and increased energy costs.

Joining the Best Mining Pools

Joining a mining pool significantly increases your chances of earning cryptocurrency rewards. Solo mining requires immense computational power and often yields little return. Pools combine the hashing power of multiple miners, increasing the frequency of block solutions and distributing the rewards amongst participants based on contributed hash rate.

Choosing the right pool is crucial. Consider factors like pool fees (which can significantly impact profitability), pool size (larger pools offer more consistent payouts but may have higher competition), payment methods, and the pool’s reputation for fairness and transparency. Researching and selecting a reputable pool with low fees and a proven track record of consistent payouts is key to maximizing your mining profits.

Payout frequency is another important factor; some pools pay out daily, while others may pay out weekly or even monthly. The optimal frequency depends on individual preferences and risk tolerance. A higher frequency may mean receiving smaller, more regular payments, whereas a lower frequency may mean receiving larger but less frequent payments. Carefully weigh the pros and cons of different payout schedules before making a decision.

Using Cloud Mining Services

Cloud mining offers a convenient and cost-effective alternative to setting up your own mining operation. Instead of investing in expensive hardware and managing its maintenance, you lease computing power from a cloud mining provider.

This eliminates the need for significant upfront capital investment in ASIC miners or GPUs. You only pay for the hashing power you use, making it accessible to those with smaller budgets.

However, thorough research is crucial. Carefully vet potential providers to avoid scams and ensure their legitimacy and profitability. Consider factors such as contract terms, hashing power offered, fees, and the provider’s reputation.

Cloud mining can offer greater scalability and flexibility compared to solo mining. You can easily adjust your hashing power according to market conditions and your budget.

Remember that cloud mining profits are dependent on several factors, including cryptocurrency prices, mining difficulty, and the provider’s performance. Understanding these factors is essential for making informed decisions.

Mining Alternative Cryptocurrencies

One of the most effective ways to boost cryptocurrency mining profitability is to explore alternative cryptocurrencies beyond Bitcoin and Ethereum. These altcoins often have lower mining difficulty, meaning you’re more likely to successfully mine a block and receive a reward. The reduced competition can lead to significantly higher returns compared to mining major cryptocurrencies.

Research is key. Thoroughly investigate different altcoins, considering factors such as their market capitalization, mining algorithm, and projected future value. Focusing on coins with a proven track record and strong community support can mitigate risk.

Consider the hardware requirements for each altcoin. Some are more computationally intensive than others, demanding specific and potentially expensive equipment. Evaluate the cost of electricity and hardware against the potential profitability before committing to a particular coin.

Diversification is also a crucial aspect. Mining multiple altcoins simultaneously can effectively spread your risk and potentially enhance your overall profit margins. However, manage the complexity and overhead associated with running multiple mining operations.

Remember that the cryptocurrency market is incredibly volatile. The profitability of mining any cryptocurrency, including altcoins, is susceptible to sudden price fluctuations and changes in mining difficulty. Constant monitoring and adaptation are crucial for long-term success.