Navigating the world of cryptocurrency trading can be daunting, but securing your digital assets is paramount. This comprehensive guide, “How to Trade Crypto Safely on Exchanges,” will equip you with the knowledge and strategies to mitigate risks and trade confidently. Learn how to choose a secure exchange, implement robust security measures such as two-factor authentication (2FA), understand the importance of wallet security, and identify potential scams and phishing attempts. We’ll cover best practices for cryptocurrency trading, covering topics like risk management, order types, and market analysis, to help you trade safely and effectively. Mastering these skills is crucial for protecting your investment and navigating the exciting, yet often volatile, world of crypto trading.

Choosing a Secure Crypto Exchange

Selecting a secure crypto exchange is paramount for safe cryptocurrency trading. Consider these key factors:

Regulation and Licensing: Prioritize exchanges operating under reputable regulatory frameworks. This provides a degree of oversight and consumer protection.

Security Measures: Look for exchanges employing robust security protocols, including two-factor authentication (2FA), cold storage for the majority of assets, and regular security audits. Research their history regarding past security breaches.

Reputation and User Reviews: Check online reviews and forums to gauge the exchange’s reputation for security and customer service. A history of positive user experiences suggests a reliable platform.

Insurance and Compensation: Some exchanges offer insurance or compensation schemes to protect users against losses due to hacking or other security incidents. Inquire about such provisions.

Transaction Fees and Withdrawal Limits: Compare fees and withdrawal limits across different exchanges. High fees can erode profits, while restrictive withdrawal limits may hinder your trading activities.

By carefully considering these aspects, you can significantly reduce your risk when choosing a cryptocurrency exchange.

Using Two-Factor Authentication (2FA)

Two-factor authentication (2FA) is a crucial security measure for protecting your cryptocurrency exchange account. It adds an extra layer of security beyond your password, significantly reducing the risk of unauthorized access.

Most exchanges offer several 2FA options, including authenticator apps (like Google Authenticator or Authy) and SMS verification. Authenticator apps are generally considered more secure than SMS due to SMS vulnerabilities.

To enable 2FA, navigate to your exchange’s security settings. You’ll typically find an option to add 2FA. Follow the on-screen instructions to set up your chosen method. Remember to back up your recovery codes; these are essential if you lose access to your authenticator app or phone.

Using 2FA is a simple yet highly effective step in safeguarding your crypto investments. It provides a critical barrier against hackers and significantly minimizes the chances of account compromise.

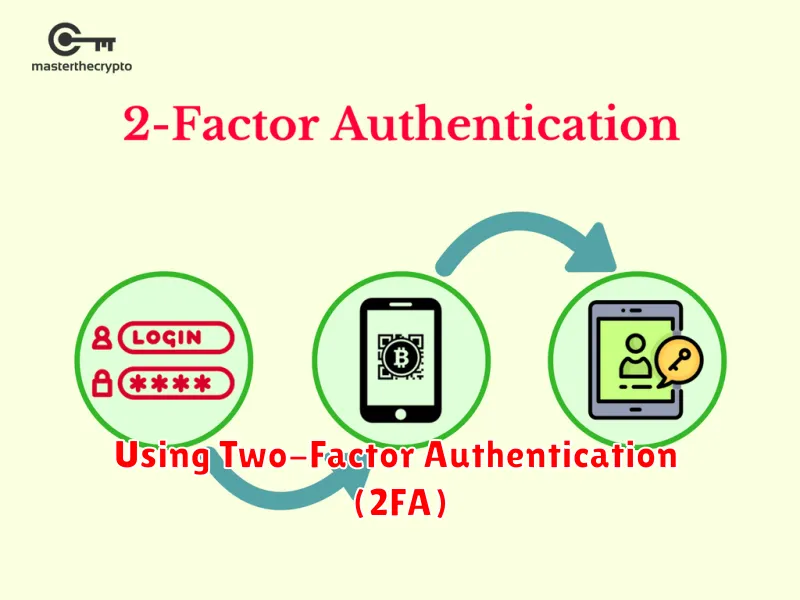

Understanding Market Orders and Limit Orders

When trading cryptocurrencies, understanding market orders and limit orders is crucial for safe and effective trading. These order types determine how your trades are executed.

A market order buys or sells an asset at the best available current market price. This guarantees immediate execution but might result in a less favorable price, especially during volatile market conditions. It’s useful for quick trades when speed is prioritized over price.

In contrast, a limit order allows you to specify the exact price at which you want to buy or sell. The order will only be executed if the market price reaches your specified limit. This gives you more control over the price, but there’s no guarantee your order will be filled if the market price doesn’t reach your limit. It’s ideal for those prioritizing a specific price point over immediate execution.

Choosing between market and limit orders depends on your trading strategy and risk tolerance. Understanding the differences is essential for mitigating risks and maximizing your chances of successful trades.

How to Avoid Trading Scams

The cryptocurrency market, while offering significant opportunities, is also rife with scams. Protecting yourself requires vigilance and a healthy dose of skepticism. Never invest in projects based solely on promises of high returns or celebrity endorsements.

Verify exchange legitimacy before depositing funds. Research the exchange thoroughly, checking for regulatory licenses and user reviews. Be wary of exchanges offering unusually high returns or promising guaranteed profits.

Beware of phishing scams. Legitimate exchanges will never ask for your private keys, seed phrases, or password via email or text message. Always access your exchange accounts directly through their official website.

Avoid unsolicited investment advice. Legitimate financial advisors will never contact you out of the blue to promote specific cryptocurrencies. Conduct your own thorough research before making any investment decisions.

Secure your accounts with strong, unique passwords and enable two-factor authentication (2FA) whenever possible. Regularly review your account activity for any unauthorized transactions.

Only trade on reputable exchanges with a proven track record and robust security measures. Avoid smaller, lesser-known exchanges that may lack adequate security protocols or regulatory oversight.

Understand the risks associated with cryptocurrency trading. Never invest more money than you can afford to lose. Remember that the cryptocurrency market is highly volatile and prices can fluctuate dramatically.

Report suspicious activity immediately to the relevant authorities and the exchange platform itself. This helps protect yourself and other users from potential scams.

Keeping Your Crypto Secure After Trading

After completing a trade, securing your cryptocurrency is paramount. Immediately withdraw your crypto assets from the exchange to a secure hardware wallet or a well-protected software wallet. Exchanges, while convenient, are vulnerable to hacking and security breaches.

Enable two-factor authentication (2FA) on all your accounts, including your exchange account and your wallet. This adds an extra layer of security, making unauthorized access significantly harder.

Regularly review your transaction history to ensure no unauthorized activity has occurred. Be vigilant about any suspicious emails or messages requesting login information.

Diversify your holdings across multiple wallets to mitigate risk. Don’t keep all your eggs in one basket, both literally and figuratively.

Strong, unique passwords are crucial. Avoid reusing passwords across different platforms and use a reputable password manager to help you generate and store them securely.

Stay updated on security best practices and patches for your wallets and software. Cryptocurrency security is an ongoing process, requiring constant vigilance.