Understanding the difference between crypto tokens and crypto coins is crucial for anyone navigating the complex world of digital currencies. While often used interchangeably, these terms represent distinct blockchain assets with unique functionalities and underlying technologies. This article will explore the basics of crypto tokens vs. coins, clarifying their key distinctions and providing a foundation for understanding the broader cryptocurrency landscape. We’ll delve into their respective use cases, underlying platforms, and overall market value to help you confidently differentiate between these important digital assets.

What is the Difference Between Tokens and Coins?

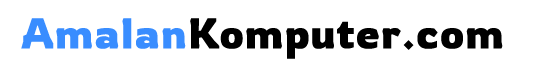

The primary difference between crypto tokens and crypto coins lies in their functionality and underlying technology. Coins, like Bitcoin and Litecoin, are independent, decentralized digital currencies with their own blockchain networks. They function as a medium of exchange and often have a specific purpose defined in their whitepaper.

Tokens, on the other hand, are built on existing blockchain networks, most commonly Ethereum. They typically represent a specific utility or asset within a particular ecosystem. These can be anything from fractional ownership in an asset to access to a specific service or platform. Essentially, tokens are built upon, and operate within, the framework of another established blockchain.

In short: coins are their own standalone cryptocurrency, while tokens are assets or utilities built on top of existing cryptocurrency networks.

Examples of Popular Crypto Coins

Bitcoin (BTC) is the original and most well-known cryptocurrency. It’s decentralized, meaning no single entity controls it.

Ethereum (ETH) is a platform for decentralized applications (dApps) and smart contracts. It’s known for its programmable nature.

Binance Coin (BNB) is the native cryptocurrency of the Binance exchange, one of the largest cryptocurrency exchanges globally. It offers various utilities within the Binance ecosystem.

Tether (USDT) is a stablecoin pegged to the US dollar, aiming to maintain a 1:1 ratio. It’s designed to minimize price volatility.

Solana (SOL) is a high-performance blockchain known for its fast transaction speeds and low fees. It supports a growing ecosystem of decentralized finance (DeFi) applications.

Cardano (ADA) is a blockchain platform focused on scalability and sustainability, employing a proof-of-stake consensus mechanism.

These are just a few examples; many other crypto coins exist, each with its unique features and use cases. It is important to conduct thorough research before investing in any cryptocurrency.

Understanding Utility Tokens and Security Tokens

Within the cryptocurrency ecosystem, the terms “token” and “coin” are often used interchangeably, but there are key distinctions. Understanding these differences is crucial for informed investment decisions. This section focuses on two significant token types: utility and security tokens.

Utility tokens grant holders access to a product or service offered by the issuing project. Think of them as digital coupons. For example, a platform might issue utility tokens that can be used to pay for access to its platform or to purchase goods and services within its ecosystem. The value of a utility token is intrinsically linked to the utility it provides; as the platform grows and its services become more valuable, so too may the token.

Security tokens, on the other hand, represent a stake in an asset or company. They provide holders with legal ownership rights, mirroring traditional securities like stocks or bonds. These tokens offer investors a claim on future profits or assets of the underlying project. Unlike utility tokens, security tokens are subject to stricter regulatory scrutiny as they are considered securities under existing laws.

The key difference lies in their functionality. Utility tokens provide access to a platform or service, while security tokens represent an investment with ownership rights and potential returns. This distinction impacts how they are regulated and valued in the market.

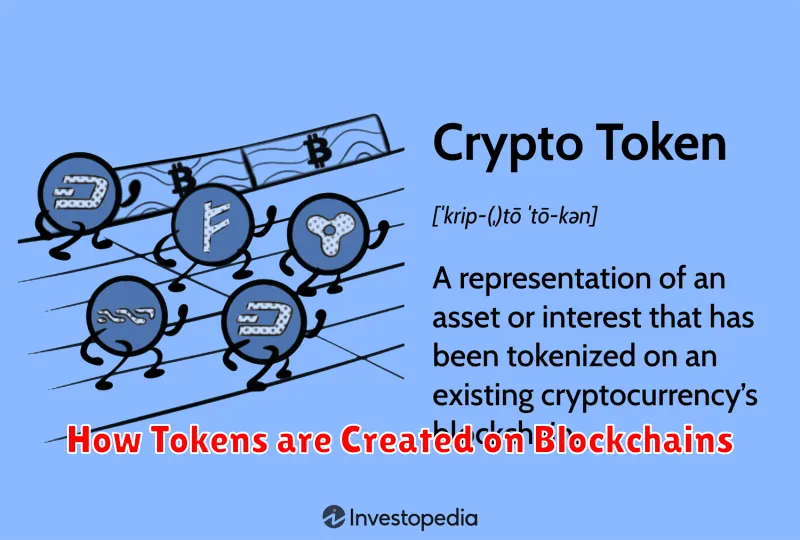

How Tokens are Created on Blockchains

Token creation on a blockchain involves a process called tokenization. This process leverages the underlying blockchain’s smart contract functionality.

First, a smart contract is written and deployed onto the blockchain. This contract defines the token’s characteristics, including its name, symbol, total supply, and functionalities (e.g., transferability, burnability).

The smart contract then facilitates the minting of tokens. This is the act of creating new tokens and assigning them to specific addresses. The specific method of minting (e.g., all tokens created at once or gradually over time) is defined within the smart contract.

Once minted, the tokens exist on the blockchain and can be transferred according to the rules programmed into the smart contract. The process differs slightly depending on the specific blockchain platform used (e.g., Ethereum, EOS, Solana), but the core principles remain consistent.

In summary, token creation involves defining the token’s features through a smart contract, deploying that contract to the blockchain, and then using the contract to mint the tokens. The resulting tokens are digitally represented on the blockchain, adhering to the defined rules and regulations.

Why Some Tokens Have Higher Value Than Coins

The value of both crypto tokens and coins is fundamentally determined by supply and demand. However, several factors contribute to why some tokens command higher valuations than coins.

Utility and adoption play a crucial role. Tokens often represent a specific utility within a blockchain ecosystem (e.g., governance rights, access to services), leading to higher demand if that utility is valuable and widely adopted. Conversely, coins often serve primarily as a medium of exchange, limiting their value proposition.

Technological advancements and innovative features also influence value. Tokens built on advanced platforms or utilizing cutting-edge technologies might attract significant investor interest and drive up their price. This is often in contrast to more established coins which may have less technological innovation.

Market sentiment and speculation significantly impact pricing. Positive news, community growth, and overall market trends can boost token prices, while negative sentiment can cause them to fall. The smaller market capitalization of some tokens makes them more susceptible to price volatility compared to established coins.

Finally, limited supply of a token can inflate its value, particularly if demand is high. This is a key component of scarcity-driven value creation, much like precious metals.