Are you interested in joining the world of Bitcoin mining in 2025? This comprehensive guide will walk you through the essential steps to successfully begin your Bitcoin mining journey. We’ll cover everything from selecting the right mining hardware and understanding mining profitability to navigating the complexities of Bitcoin mining pools and ensuring your operation’s security and efficiency. Whether you’re a seasoned cryptocurrency investor or a complete beginner, this guide will equip you with the knowledge to start your Bitcoin mining operation in 2025.

Understanding Bitcoin Mining Basics

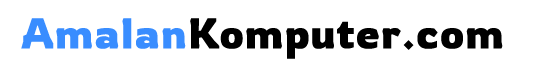

Bitcoin mining is the process of verifying and adding new transactions to the Bitcoin blockchain. Miners use powerful computers to solve complex mathematical problems, a process known as proof-of-work.

Successful miners are rewarded with newly minted Bitcoins and transaction fees. The difficulty of these problems adjusts automatically to maintain a consistent block generation time of approximately 10 minutes. This ensures the network’s security and stability.

Hardware plays a crucial role; specialized ASIC (Application-Specific Integrated Circuit) miners are significantly more efficient than CPUs or GPUs for Bitcoin mining. The higher the hash rate (calculations per second) of your hardware, the greater your chances of solving a problem and earning rewards.

Energy consumption is a significant factor. Bitcoin mining requires substantial electricity, impacting both profitability and environmental concerns. Mining pools allow individual miners to combine their computational power, increasing their chances of finding a block and sharing the rewards proportionally.

Understanding these basics—proof-of-work, hardware requirements, energy costs, and the role of mining pools—is essential before embarking on Bitcoin mining in 2025.

Choosing the Right Mining Hardware

Bitcoin mining in 2025 requires careful consideration of your mining hardware. The most crucial factor is the hash rate, which measures the computational power of your equipment. Higher hash rates translate to a greater chance of solving complex cryptographic problems and earning Bitcoin rewards.

Application-Specific Integrated Circuits (ASICs) are the dominant choice for Bitcoin mining due to their superior efficiency and hash rate compared to CPUs or GPUs. Several manufacturers offer ASIC miners with varying hash rates and power consumption. Selecting the right ASIC depends on your budget and electricity costs. Higher hash rate ASICs require more power and are often more expensive.

Beyond the hash rate, consider the power consumption (measured in Watts) and the noise level. High power consumption leads to higher electricity bills, while excessive noise can be disruptive. Look for ASICs with good efficiency ratings (measured in J/GH) for optimized power usage.

Finally, research the reliability and manufacturer reputation before purchasing. A reputable manufacturer will offer warranties and support. Consider the lifespan of the equipment and potential maintenance costs. Mining hardware is subjected to wear and tear, and occasional repairs are possible.

Setting Up a Crypto Mining Rig

Setting up a Bitcoin mining rig in 2025 requires careful planning and investment. The core components include ASIC miners, chosen based on their hash rate and power consumption. Consider the hashrate; higher is better, but also consumes more power.

You’ll also need a powerful power supply capable of handling the miners’ demands. Cooling solutions are crucial; high-performance miners generate significant heat, necessitating robust fans, possibly liquid cooling systems, or a dedicated air conditioning unit.

A mining motherboard is needed to connect and manage the ASICs, while a suitable chassis will house all the components. You’ll need reliable internet connectivity with low latency for optimal performance. Finally, monitoring software allows you to track your mining operations and optimize performance. Remember to research power costs in your area as this will heavily impact your profitability.

Joining a Bitcoin Mining Pool

Joining a Bitcoin mining pool is crucial for most individual miners in 2025. Solo mining, attempting to solve the complex cryptographic puzzles independently, is exceptionally difficult and unlikely to yield a profit due to the intense competition and high computational power required.

Pools aggregate the hashing power of many miners, increasing the chances of successfully mining a block. When a block is solved, the reward is distributed amongst the pool members proportionally to their contributed hash rate. This ensures a more consistent and predictable income stream, unlike the unpredictable nature of solo mining.

Choosing a pool involves considering factors like pool fees, payout methods (e.g., Pay Per Share (PPS), Proportional), pool size (larger pools generally offer more consistent payouts but may have higher fees), and server stability and reliability. Researching and comparing different pools before joining is vital to maximizing profitability.

The process of joining typically involves creating an account on the chosen pool’s website and then configuring your mining software to connect to the pool’s servers. This will require providing your mining wallet address where your Bitcoin rewards will be sent. It’s important to carefully follow the pool’s specific instructions.

Calculating Mining Profitability

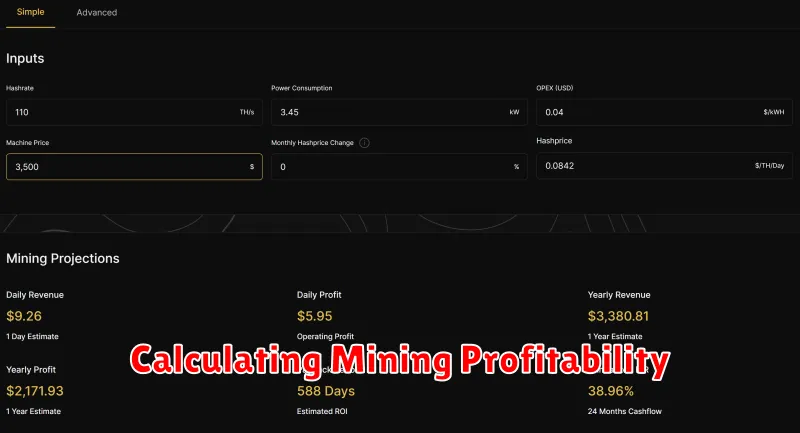

Accurately calculating Bitcoin mining profitability in 2025 requires a multifaceted approach. Several key factors must be considered for a realistic assessment.

First, determine your hardware’s hash rate. This measures its computational power, directly influencing your chances of solving a block and earning Bitcoin. Higher hash rates generally translate to increased earning potential, but come with a higher upfront cost.

Next, account for your electricity costs. Mining consumes significant energy; electricity price per kilowatt-hour (kWh) is crucial. High electricity costs can drastically reduce profits, potentially making mining unprofitable.

Bitcoin’s price is a pivotal factor. Fluctuations in Bitcoin’s value significantly impact profitability. A rising Bitcoin price boosts profits, while a drop diminishes them.

Mining difficulty also plays a critical role. As more miners join the network, the difficulty of solving blocks increases, making it harder to earn Bitcoin. This difficulty adjusts dynamically, impacting your potential earnings.

Finally, factor in hardware maintenance and replacement costs. Mining hardware degrades over time and may require repairs or replacements, adding to operational expenses.

To calculate profitability, subtract your total operational costs (electricity, hardware maintenance, etc.) from your estimated Bitcoin earnings. This will give you a net profit or loss. Utilize online mining profitability calculators, available from various sources, to simplify this process. Remember that these are estimations and actual results may vary.