Maximize your cryptocurrency mining profits by joining the best mining pools. This article explores top contenders, comparing hashrates, fees, and payout systems to help you choose the optimal pool for your mining rig and achieve maximum profitability. Learn how to select a pool that best suits your specific needs and unlock the full potential of your mining operation.

What is a Crypto Mining Pool?

A crypto mining pool is a group of miners who combine their computing power to increase their chances of successfully mining a block of cryptocurrency and earning the associated reward. Individual miners often have limited resources, making it difficult to compete with larger mining operations. By pooling resources, miners share the rewards proportionally to their contributed computing power, increasing the frequency of payouts.

Joining a pool significantly reduces the risk and uncertainty associated with solo mining, offering a more consistent and predictable income stream. While individual miners might go for extended periods without earning any rewards, pool members receive smaller, more regular payouts.

The benefits include increased efficiency, reduced variance in earnings, and shared operational costs. However, a percentage of the mined cryptocurrency is typically deducted as a pool fee, which varies between different pools.

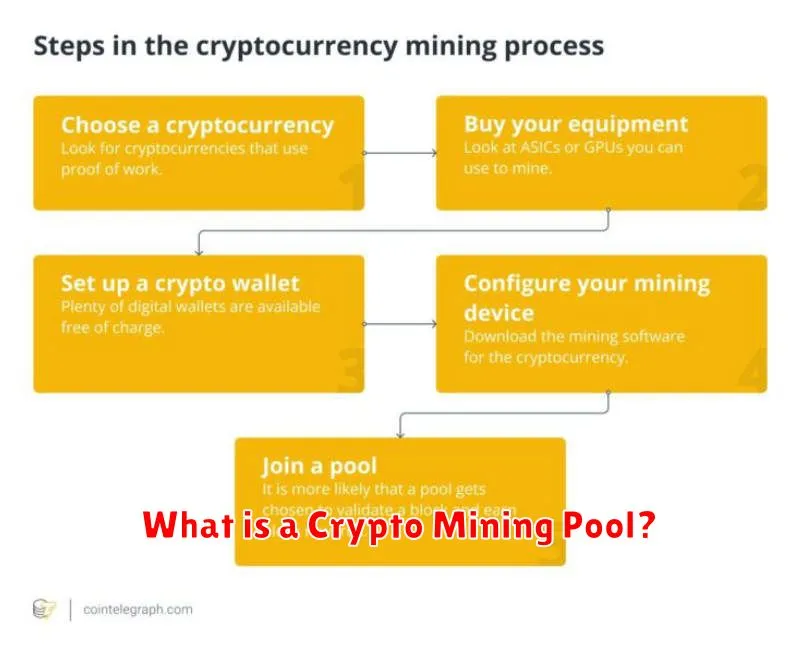

Best Bitcoin Mining Pools in 2025

Predicting the best Bitcoin mining pools in 2025 is challenging due to the dynamic nature of the cryptocurrency market. However, several factors will likely influence their ranking. Hashrate, fees, and payment methods will remain crucial considerations. Pools with proven track records of reliability, transparency, and efficient payouts will likely continue to attract miners.

Poolin, AntPool, and F2Pool are currently major players, known for their large hashrates and established infrastructure. Their continued success will depend on adapting to evolving technologies and maintaining competitive fee structures. Newer pools with innovative approaches to mining and payout systems could emerge as significant contenders. The rise of ASIC resistance algorithms could also reshape the landscape, favoring pools that support such algorithms.

Ultimately, the best pool for an individual miner will depend on their specific hardware, mining strategy, and risk tolerance. It’s recommended to research various pools and compare their features before making a decision. Factors such as minimum payout thresholds, pool fees, and payment frequency should all be carefully evaluated.

It is crucial to remember that the Bitcoin mining landscape is volatile and predictions are inherently uncertain. Continuous monitoring of pool performance and adapting to market changes will be essential for maximizing profits in 2025.

Top Ethereum Mining Pools

Choosing the right Ethereum mining pool is crucial for maximizing profits. Profitability depends on several factors, including pool fees, block rewards, and the pool’s overall hashrate and luck.

Some of the top Ethereum mining pools known for their efficiency and reliability include Ethermine, SparkPool, and Nanopool. These pools often boast large hashrates, leading to more frequent block rewards and potentially higher payouts. However, it’s important to research each pool individually to compare fees and payout methods before making a decision.

Other noteworthy pools include Hiveon and 2Miners, each offering distinct features and varying levels of transparency. Consider factors like minimum payout thresholds and the pool’s payment system when selecting a pool.

Remember that pool performance can fluctuate. Monitoring your chosen pool’s performance and comparing it to others is essential for optimizing your mining operation. Regularly evaluating your pool choice ensures you’re consistently maximizing your returns.

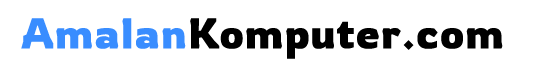

How to Join a Mining Pool

Joining a mining pool is a straightforward process, generally involving these steps:

1. Choose a Pool: Select a mining pool based on factors like hashrate, fees, and payout methods. Research different pools to find one that best suits your needs and mining hardware.

2. Create an Account: Most pools require you to create a free account. You’ll need to provide a valid email address and possibly other information.

3. Configure Your Miner: You’ll need to configure your mining software (e.g., CGMiner, BFGMiner) with the pool’s server address, your worker name (often assigned by the pool), and your wallet address. This ensures your mined coins are sent to your designated wallet.

4. Start Mining: Once your miner is correctly configured, start the mining process. Your miner will begin submitting hashes to the pool, contributing to the collective mining power.

5. Monitor Your Progress: Regularly check your pool account to monitor your earnings and hashrate contribution. Most pools provide dashboards to track your performance.

The specific steps may vary slightly depending on the chosen pool and mining software. Always refer to the pool’s documentation for detailed instructions.

Mining Pool Fees and Payouts Explained

Mining pools facilitate cryptocurrency mining by aggregating the hashing power of many miners. To operate, pools charge fees, typically a percentage of the mined cryptocurrency. These fees vary widely, ranging from 0% to upwards of 2%. It’s crucial to compare fees across different pools to maximize your earnings.

Payouts refer to how often and in what amounts miners receive their share of the rewards. Common payout methods include Pay Per Share (PPS), Pay Per Last N Shares (PPLNS), and Full Pay Per Share (FPPS). PPS provides consistent payouts regardless of the pool’s luck, while PPLNS and FPPS are more variable and can be affected by the pool’s overall mining success. The choice of payout method impacts the consistency of your income.

Understanding minimum payout thresholds is also vital. Pools often set a minimum amount of cryptocurrency before releasing payments to miners. This can influence the frequency of your earnings and should be considered when selecting a pool.

Finally, some pools offer additional fees or deductions for various services. These might include features like advanced monitoring tools or priority transaction processing. Transparency regarding these added costs is crucial for accurate profit calculations.