Choosing the right crypto exchange can be daunting, given the sheer number of platforms available. This comprehensive guide will help you navigate the complexities of selecting the best crypto exchange for your specific needs. We’ll cover crucial factors like security, fees, available cryptocurrencies, trading features, and user experience, empowering you to make an informed decision and confidently begin your cryptocurrency trading journey. Learn how to identify the platform that offers the optimal blend of security, functionality, and value for your individual investment strategy.

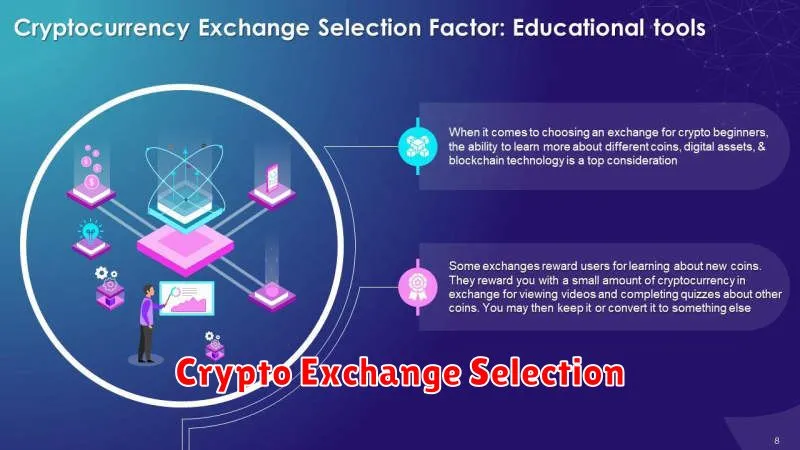

Factors to Consider When Choosing an Exchange

Selecting the right cryptocurrency exchange is crucial for a positive trading experience. Several key factors should guide your decision.

Security is paramount. Look for exchanges with robust security measures, including two-factor authentication (2FA), cold storage for a significant portion of their assets, and a proven track record of protecting user funds. Research any past security breaches or vulnerabilities.

Fees significantly impact profitability. Compare trading fees (maker/taker fees), deposit/withdrawal fees, and any other charges. Some exchanges offer tiered fee structures based on trading volume.

The range of available cryptocurrencies is a major consideration. Ensure the exchange lists the assets you intend to trade. Consider the liquidity of those assets – higher volume generally means better execution prices.

User interface (UI) and user experience (UX) are vital for a smooth trading process. A well-designed platform is intuitive and easy to navigate, even for beginners. Consider features like charting tools and order types.

Regulation and compliance provide a layer of protection. Choose exchanges that operate under a recognized regulatory framework and adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines. This adds an element of trust and security.

Finally, consider the customer support offered by the exchange. Responsive and helpful support is crucial in resolving any issues that might arise.

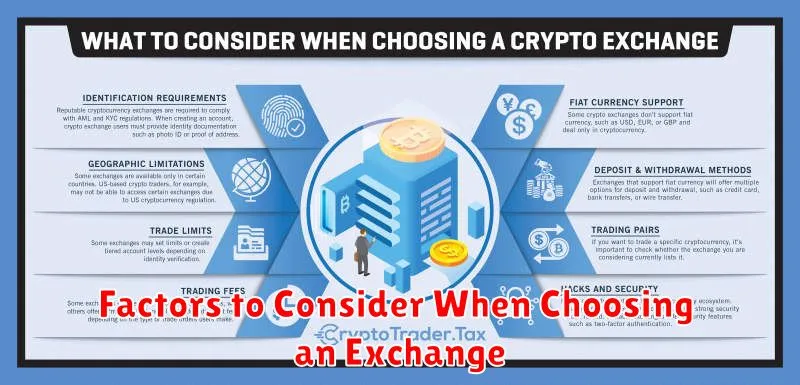

Centralized vs. Decentralized Exchanges

Choosing between a centralized exchange (CEX) and a decentralized exchange (DEX) is a crucial step in selecting the best crypto exchange for your needs. Each type offers distinct advantages and disadvantages.

Centralized exchanges, like Coinbase or Binance, act as intermediaries, holding your funds in their custody. This offers a generally easier user experience with features such as fiat on-ramps and higher liquidity. However, this convenience comes at the cost of security risks associated with a single point of failure and reliance on the exchange’s security practices. Furthermore, CEXs often impose know-your-customer (KYC) and anti-money laundering (AML) regulations.

Decentralized exchanges, on the other hand, operate without a central authority. Users retain control of their private keys, enhancing security and privacy. Trading happens directly between users, minimizing the risk of exchange hacks or fraud. However, DEXs often have lower liquidity, higher transaction fees, and a steeper learning curve for less technically savvy users. The user interface and functionality can also be less polished compared to CEXs.

The best choice depends on your priorities. If ease of use, high liquidity, and a wide range of features are paramount, a CEX might be preferable. If security and privacy are your top concerns, and you’re comfortable navigating a more complex interface, a DEX may be a better fit. Consider your risk tolerance, technical skills, and trading volume when making your decision.

Understanding Trading Fees and Liquidity

Choosing the right cryptocurrency exchange involves carefully considering trading fees and liquidity. These two factors significantly impact your profitability and trading experience.

Trading fees represent the costs associated with buying and selling cryptocurrencies. These fees can vary considerably across exchanges and are often structured as maker/taker fees (based on whether your order adds or removes liquidity) or flat fees. Lower fees translate directly to higher profits, making fee comparison crucial.

Liquidity refers to the ease with which you can buy or sell an asset without significantly impacting its price. A highly liquid exchange boasts large order books, meaning many buyers and sellers are actively trading, allowing for quick execution of trades at competitive prices. Low liquidity can lead to slippage (the difference between the expected price and the actual execution price) and difficulty in filling large orders.

Therefore, the best exchange for you will depend on your trading volume and style. High-volume traders prioritize low trading fees, while all traders benefit from high liquidity to minimize slippage and ensure efficient trade execution. Carefully analyze fee structures and order book depth before selecting an exchange.

Security Features to Look for

Choosing a crypto exchange requires careful consideration of its security features. Two-factor authentication (2FA) is paramount; it adds an extra layer of protection beyond just a password. Look for exchanges offering various 2FA options like authenticator apps (Google Authenticator, Authy) and hardware security keys (YubiKey).

Cold storage of the majority of funds is a crucial security measure. Exchanges should transparently explain how they safeguard user assets and ideally, regularly undergo independent security audits. Check for the use of SSL encryption to protect data transmitted between your device and the exchange.

Investigate the exchange’s history and reputation. Have they experienced any significant security breaches in the past? A robust insurance policy covering user funds in the event of a hack adds extra security. Finally, verify that the exchange complies with relevant regulations and adheres to best practices in data privacy and security.

Best Platforms for Buying and Selling Crypto

Choosing the right cryptocurrency exchange is crucial for a smooth and secure trading experience. Several platforms stand out for their user-friendliness, security features, and range of offered cryptocurrencies.

Coinbase is a popular choice for beginners, offering a user-friendly interface and robust security measures. It supports a wide variety of cryptocurrencies and provides educational resources for newcomers.

Kraken is known for its advanced trading features and lower fees, making it attractive to more experienced traders. It offers a broader range of cryptocurrencies compared to some other platforms and boasts strong security protocols.

Binance, while having a steeper learning curve, is one of the largest exchanges globally, offering a vast selection of cryptocurrencies and competitive trading fees. Its advanced features cater to both beginners and experienced users.

Gemini prioritizes security and regulation, making it a solid option for those who value a trustworthy and compliant exchange. It offers a streamlined user experience and supports a good selection of cryptocurrencies.

The best platform for you will ultimately depend on your individual needs and experience level. Consider factors like user interface, security, fees, supported cryptocurrencies, and available trading features when making your decision.