Understanding the cryptocurrency market cap is crucial for navigating the volatile world of digital assets. This beginner’s guide will demystify market capitalization, explaining how it’s calculated and what it reveals about the relative size and strength of different cryptocurrencies. Learn how to use market cap data to make informed investment decisions and avoid common pitfalls in the crypto market. We’ll cover essential topics such as total market cap, its relationship to cryptocurrency price, and its importance in assessing cryptocurrency investment risk. Whether you’re a complete novice or have some familiarity with digital currencies, this guide will provide the foundation you need to confidently interpret market cap data and navigate the exciting, yet challenging, landscape of crypto investing.

What is Market Capitalization?

Market capitalization, often shortened to market cap, represents the total market value of a company or, in the case of cryptocurrencies, a specific cryptocurrency.

It’s calculated by multiplying the current market price of a single unit (e.g., one Bitcoin or one Ethereum) by the total number of units in circulation.

For example, if a cryptocurrency has a price of $100 and 10 million units are circulating, its market cap would be $1 billion ($100 x 10,000,000).

Market cap is a crucial metric for assessing the size and relative value of a cryptocurrency within the broader market. A higher market cap generally indicates a larger, more established, and potentially less volatile cryptocurrency, though this is not always the case.

How Market Cap Affects Crypto Prices

Market capitalization, or market cap, is a crucial factor influencing cryptocurrency prices. It represents the total value of a cryptocurrency’s circulating supply. A higher market cap generally suggests a more established and potentially less volatile cryptocurrency, as it requires a larger amount of investment to significantly move its price.

Conversely, cryptocurrencies with a lower market cap are often considered more volatile. Smaller market caps mean that even relatively small changes in buying or selling pressure can lead to significant price swings. This is because a smaller amount of investment is needed to impact the price significantly. Therefore, understanding a cryptocurrency’s market cap is vital for assessing its potential risk and reward.

Market cap doesn’t directly determine price movement, but it’s a strong indicator of a cryptocurrency’s overall stability and liquidity. A large market cap suggests greater stability and resistance to dramatic price changes. However, it’s essential to consider other factors alongside market cap when making investment decisions, including project fundamentals, technological advancements, and overall market sentiment.

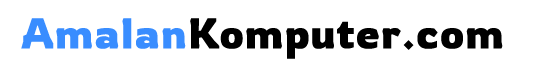

Large Cap vs. Small Cap Cryptos

Understanding the difference between large-cap and small-cap cryptocurrencies is crucial for navigating the cryptocurrency market. Market capitalization, or market cap, represents the total value of a cryptocurrency’s circulating supply. It’s calculated by multiplying the current price of a coin by its total circulating supply.

Large-cap cryptocurrencies typically have a market cap exceeding billions of dollars. These are generally considered more established and less volatile than their smaller counterparts. They often boast larger communities, greater liquidity, and more established infrastructure. Examples include Bitcoin and Ethereum.

Small-cap cryptocurrencies, on the other hand, possess smaller market caps, often in the millions or tens of millions of dollars. While they offer potentially higher returns due to their higher volatility, they also carry significantly more risk. Their smaller market caps make them more susceptible to price swings and manipulation. Small-cap projects are often considered higher-risk, higher-reward investments.

The choice between investing in large-cap or small-cap cryptocurrencies depends entirely on your risk tolerance and investment goals. Large-cap cryptos offer stability and lower risk, while small-cap cryptos present potentially greater rewards, but with considerably greater risk.

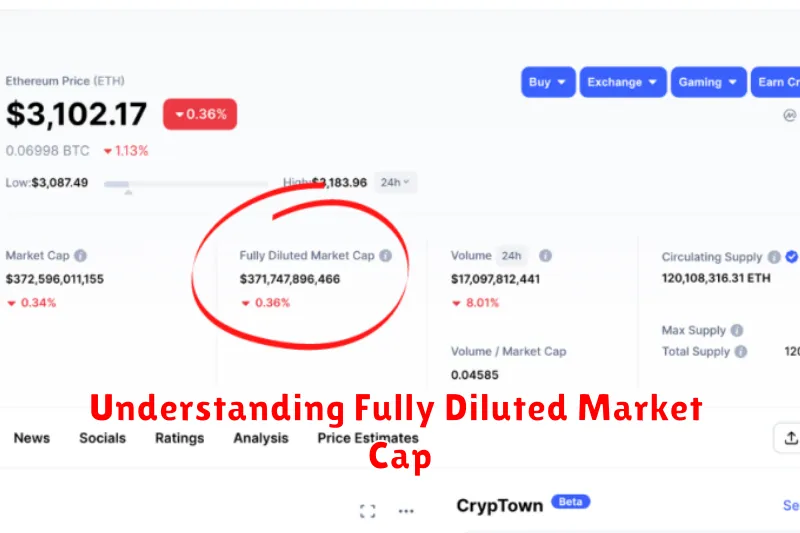

Understanding Fully Diluted Market Cap

The fully diluted market cap represents the total market capitalization of a cryptocurrency if all its tokens or coins were in circulation. This includes tokens currently held by the company, founders, or locked in escrow, that are eventually planned to be released into the market.

It provides a more comprehensive picture of a cryptocurrency’s potential market value compared to the circulating market cap, which only considers the coins actively traded. This is because the circulating supply can significantly change over time as more tokens are released.

Understanding the difference between fully diluted and circulating market cap is crucial for investors. While the circulating market cap reflects the current market value, the fully diluted market cap helps anticipate the potential impact of future token releases on the price.

A high fully diluted market cap compared to the circulating market cap can suggest potential downward pressure on the price once additional tokens enter circulation. Conversely, a low fully diluted market cap relative to the circulating market cap could indicate potential for future price appreciation.

Always consider both fully diluted and circulating market caps when evaluating a cryptocurrency’s value and potential for future growth. This provides a much more complete and informative analysis.

Why Market Cap Matters for Investors

Understanding market capitalization (market cap) is crucial for cryptocurrency investors. It provides a snapshot of a cryptocurrency’s overall value, representing the total value of all its circulating coins.

Market cap helps investors gauge the size and potential of a cryptocurrency project. A larger market cap generally suggests a more established and potentially less volatile asset, though not always. Conversely, smaller market cap cryptocurrencies may offer higher potential returns but also carry significantly greater risk.

Investors use market cap to compare different cryptocurrencies, prioritize investment opportunities, and manage portfolio risk. While not a perfect indicator of future performance, market cap offers valuable context within a broader investment analysis.

Analyzing market cap trends can also provide insights into market sentiment and overall cryptocurrency adoption. A rapidly increasing market cap may indicate strong investor interest, while a declining market cap may signal waning confidence.